Card Settings

As your child grows and develops their financial understanding, you may need to adjust their card settings. This guide outlines tools for better control and oversight—such as adjusting credit limits, changing the card's appearance, temporarily freezing the card, and more.

Accessing Card Settings

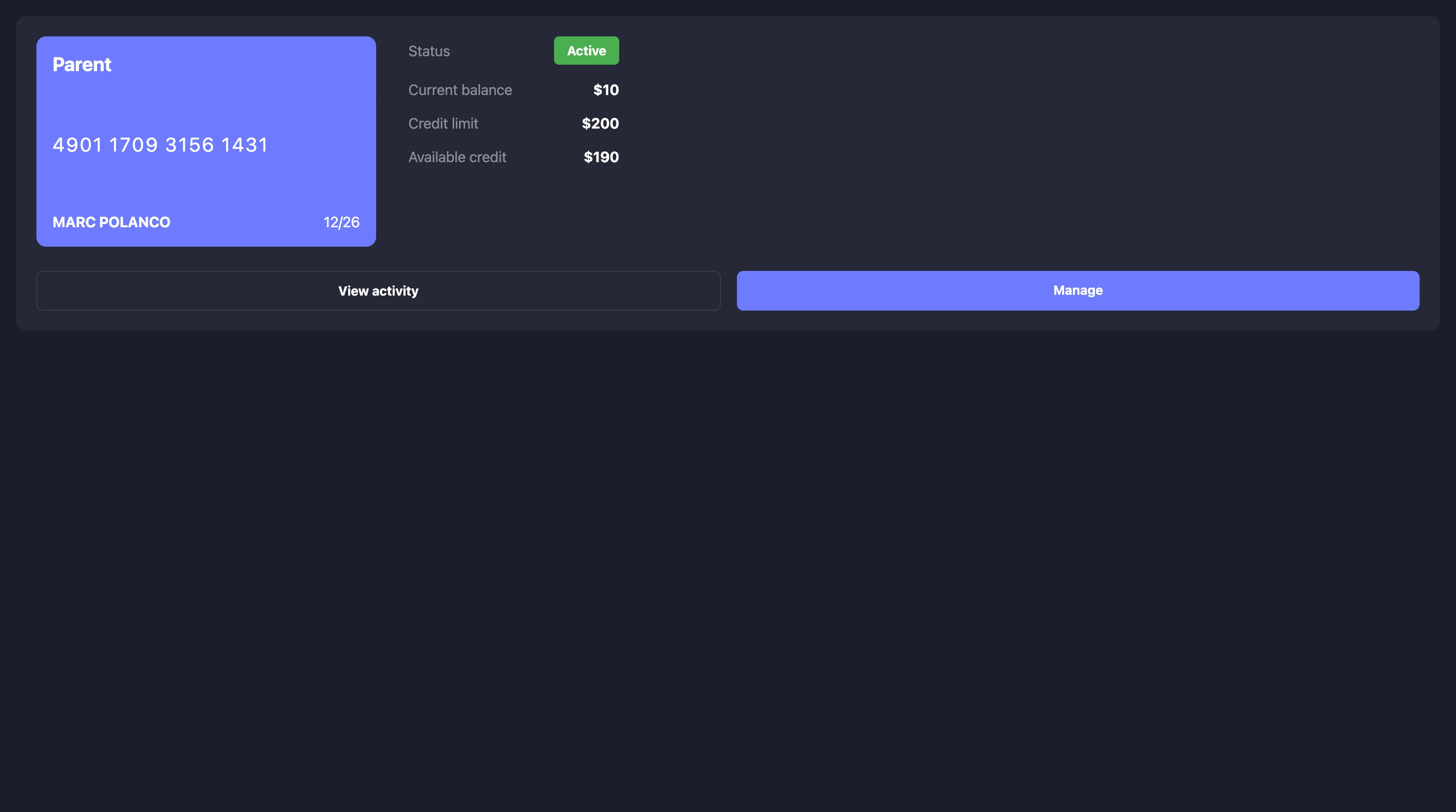

Navigate to card management

From your dashboard, find the card you want to manage and click the "Manage" button. This will take you to the card's detailed view with multiple tabs for different functions.

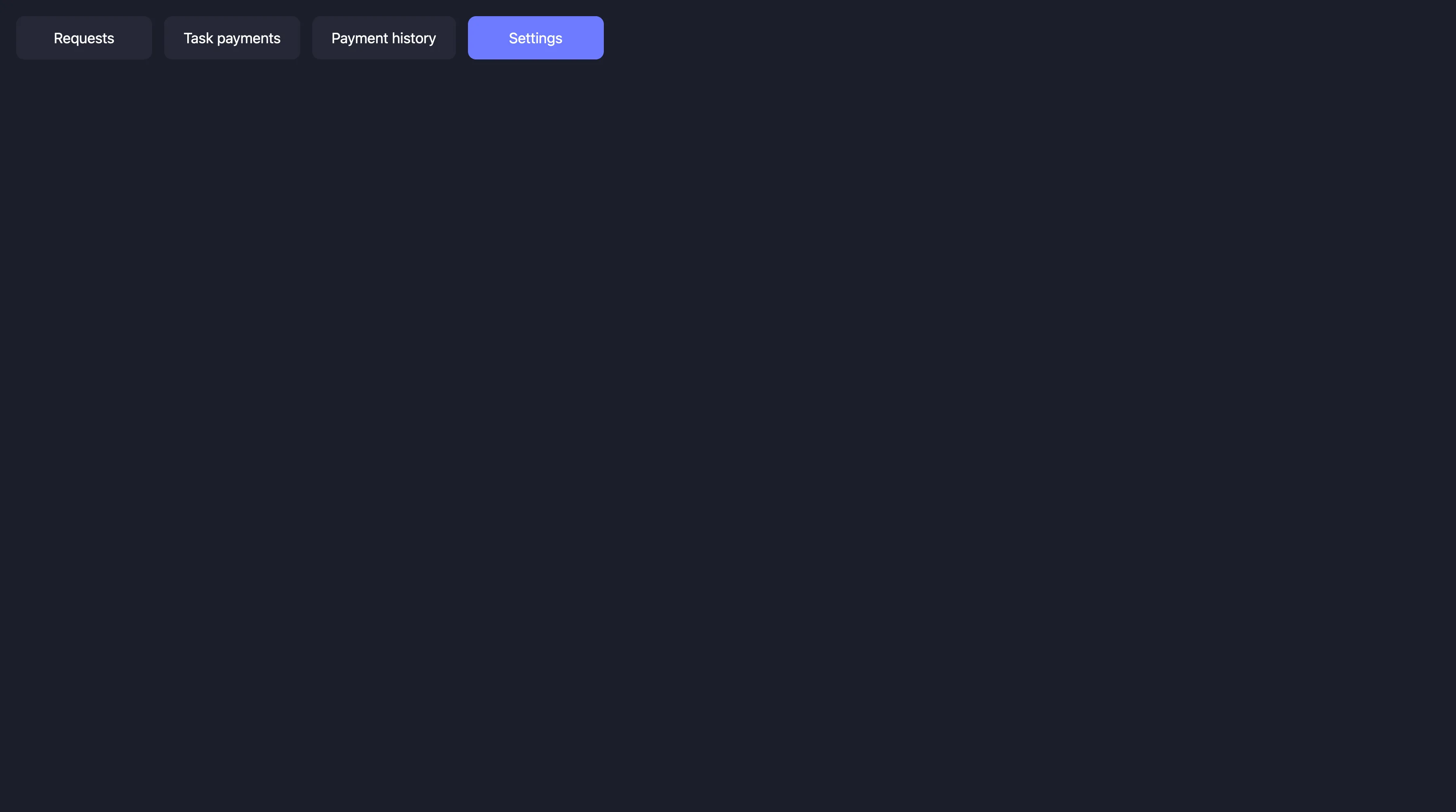

Select the Settings tab

Once in the card management view, click on the "Settings" tab to access all configurable options for the card. This is where you can adjust credit limits, change the card's appearance, and manage other settings.

Adjusting Card Settings

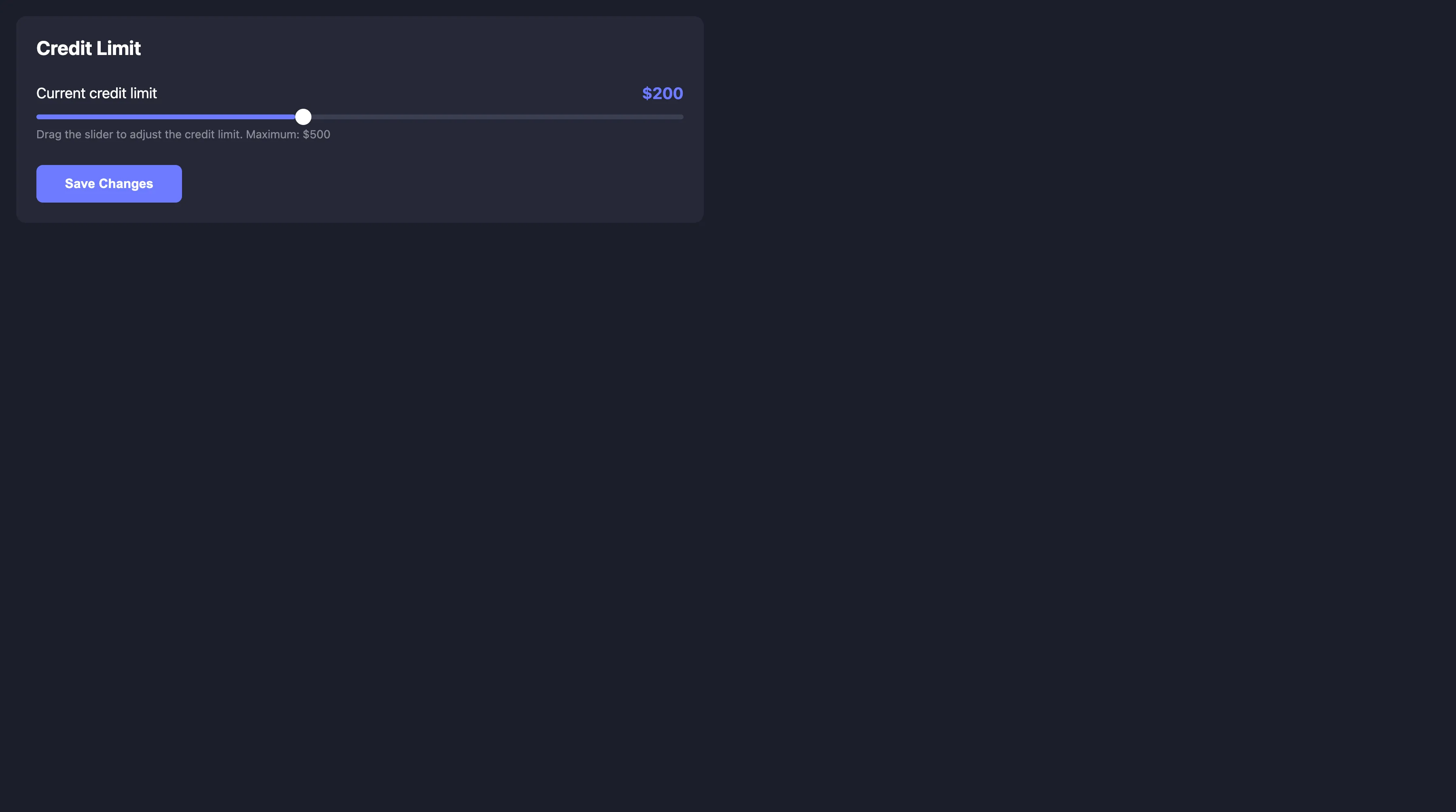

Change credit limit

Changing the credit limit is one of the most common settings adjustments. As your child demonstrates responsible credit usage, you may want to increase their limit to provide more financial flexibility and learning opportunities.

Pro Tip

Gradually increasing your child’s credit limit is a simple way to demonstrate responsible financial behavior. This creates a sense of achievement and helps them learn to manage larger amounts of credit over time.

Change card appearance

You can customize the appearance of your child's virtual card by changing its color. This is a fun way to personalize the experience and can be especially motivating for younger children.

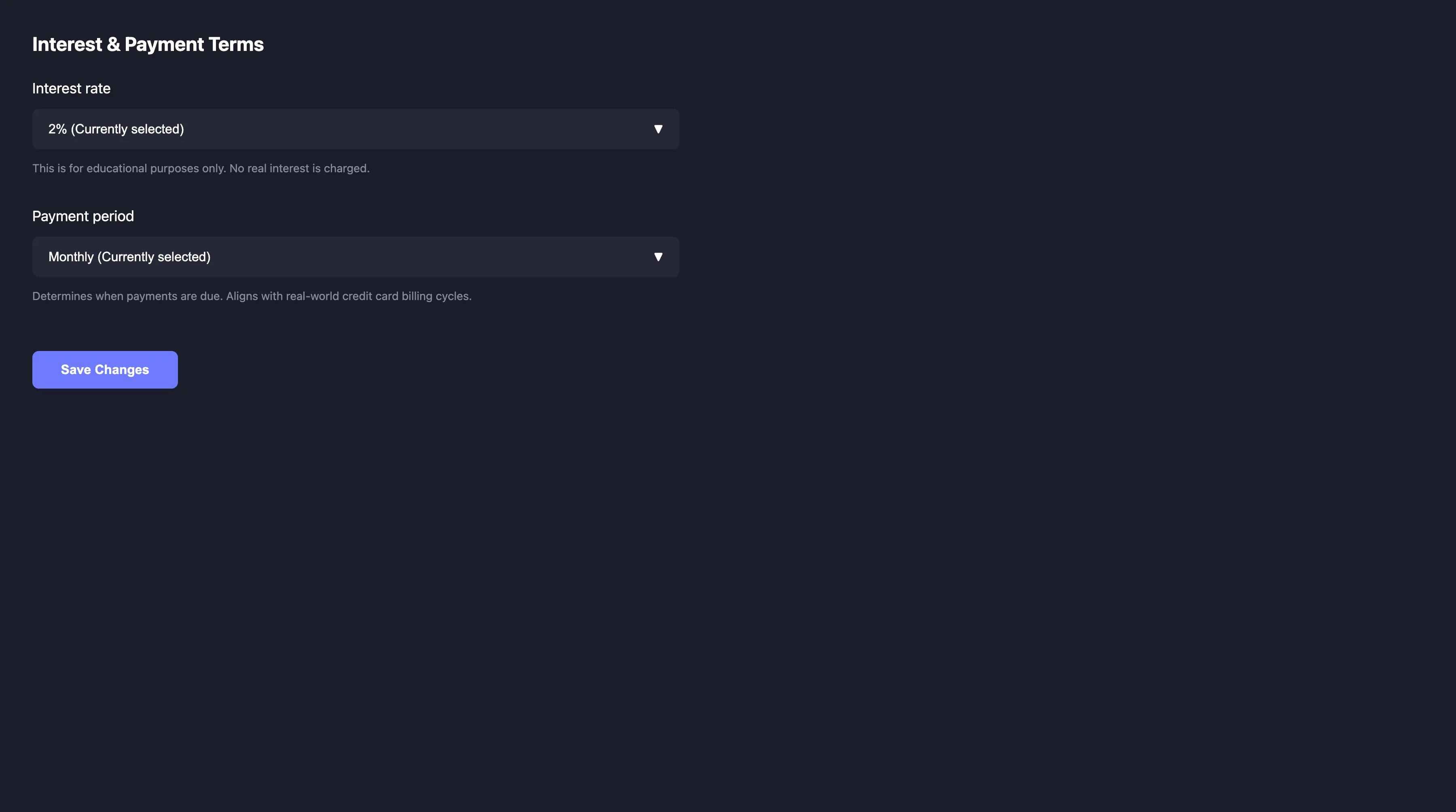

Adjust interest rate and payment terms

Parent credit allows you to set interest rates and payment terms at levels appropriate for teaching children how credit systems work. You can adjust these settings to align with your child's age and learning goals.

Teaching Opportunity

When adjusting interest rates or payment terms, take time to explain to your child how these changes would affect real-world credit cards. This helps them understand how different interest rates and payment schedules affect overall debt.

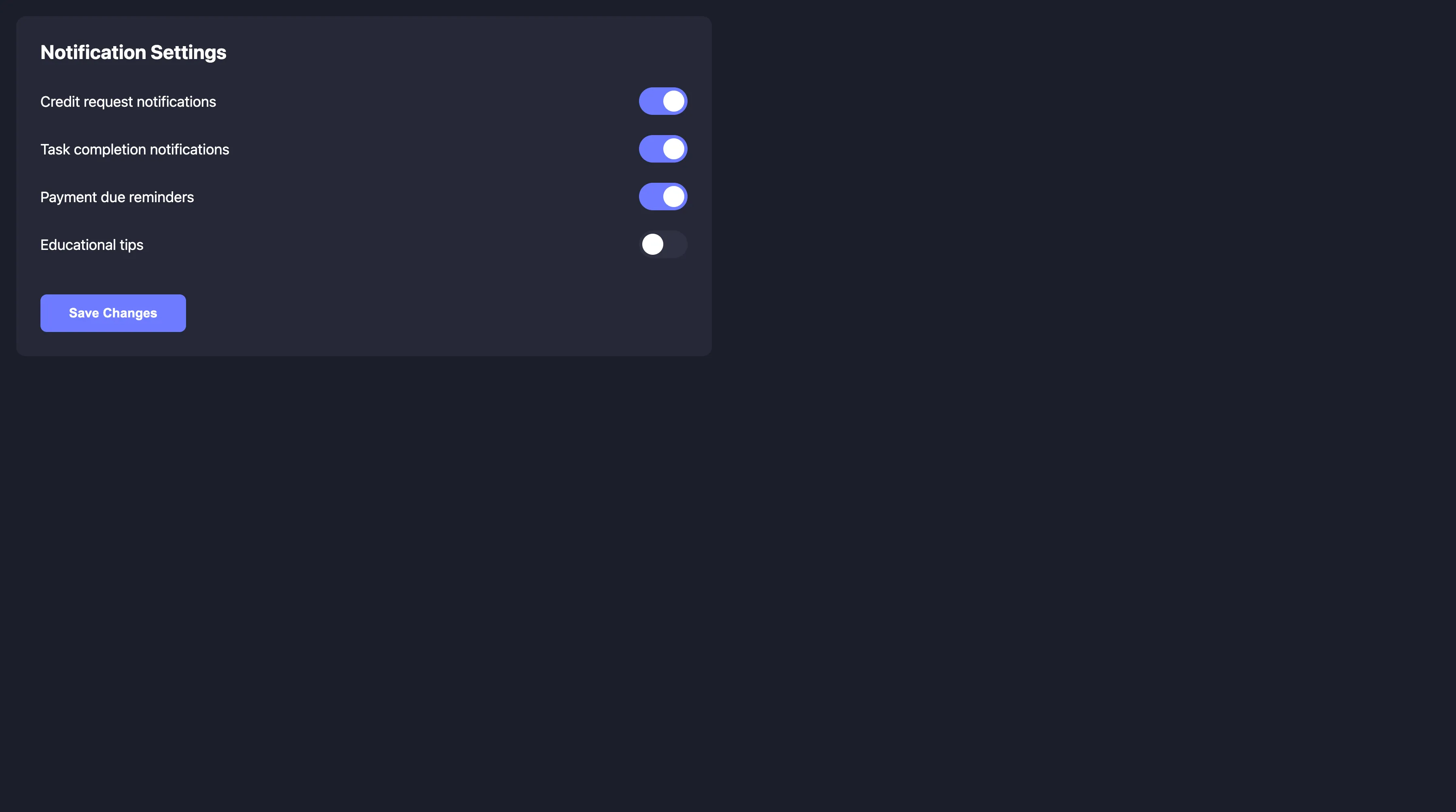

Enable/disable notifications

You can control which notifications you receive about your child's card activity. This allows you to stay informed about important events while avoiding alert fatigue from less critical updates.

Card Management Actions

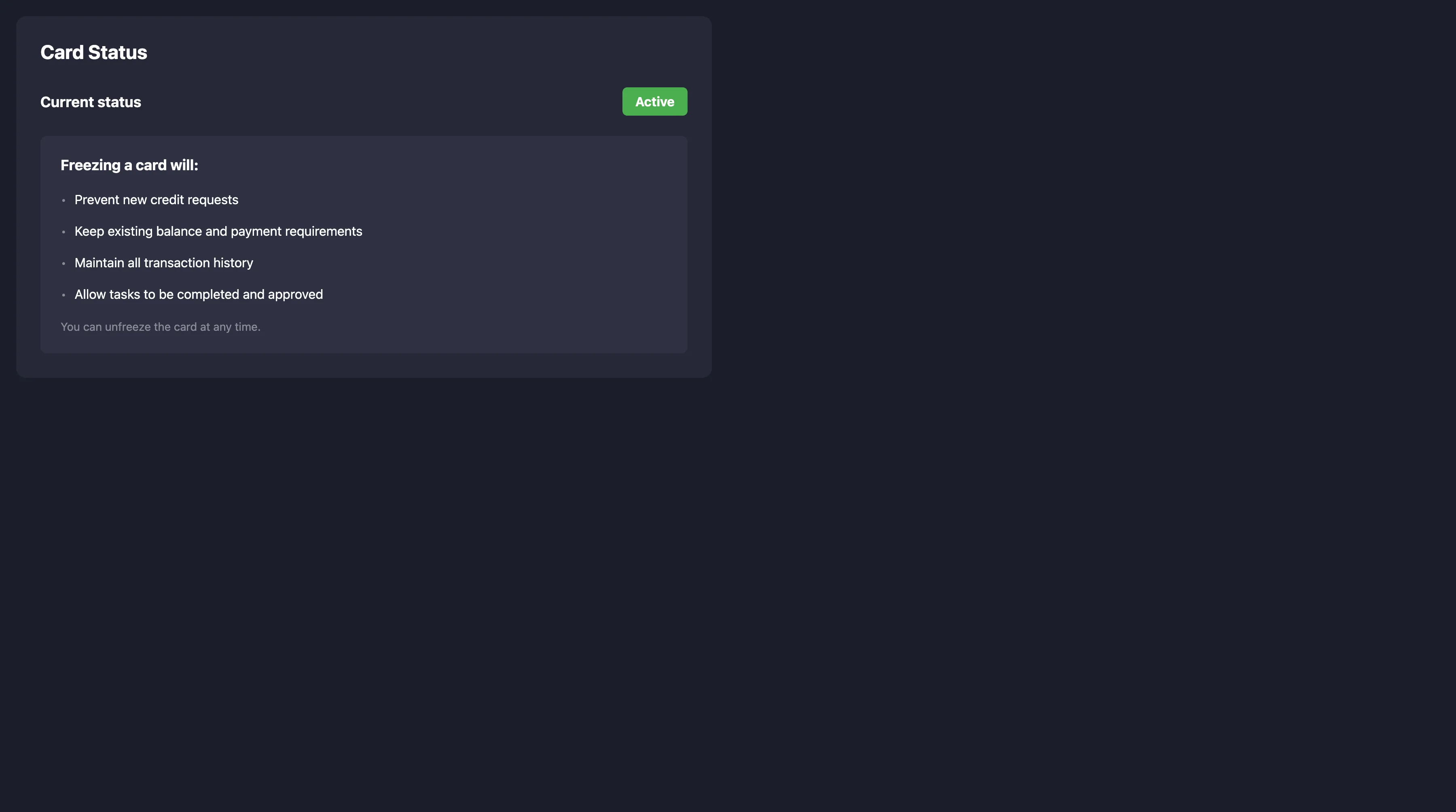

Freeze card

To temporarily prevent your child from making new credit requests, you can freeze their card. This is useful in situations where you want to pause activity without deleting the card entirely.

Freezing a card will:

- Block new credit requests

- Preserve the current balance and repayment terms

- Maintain full transaction history

- Allow ongoing tasks to be completed and approved

You can unfreeze the card at any time.